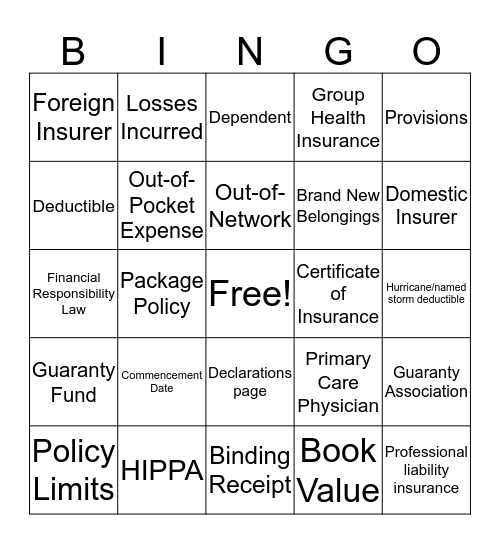

This bingo card has a free space and 299 words: Claims, Fire, Deductible, Water, Actuary, Additional insured, Additional living expense, Adjuster, Liability, Medical Payments, Agent, Storm, Personal Property, Theft, Risk, Applicant, Application, Appraisal, Peril, Scheduled Personal Property, Assigned Risk, Brand New Belongings, Inventory, Binder, Automatic Premium Loan, Beneficiary, Binder, Binding Receipt, Blanket coverage, Boatowners/Personal Watercraft, Bodily injury liability coverage, Bonds, Book Value, Brand New Belongings, Broker, Broker Builders' Risk, Burglary Business Auto, Burial Insurance, Business owners Policy, Buy-Sell Agreements, Calendar Year Deductible, Cancellation, Case Management, Cash Value, Casualty Insurance, Catastrophe Loss, Certificate of Insurance, Claim, Claimant, Class Rating, Classic automobile, Classic car insurance, Coastal area, COBRA (Consolidated Omnibus Budget Reconciliation Act), Coinsurance, Collision coverage, Collision insurance, Commencement Date, Commercial Auto, Commercial Property, Commission, Comprehensive coverage, Conditions, Condominium owners policy, Condos, Construction type, Contingent Beneficiary, Continuous insurance, Contract, Conversion Privilege, Convertible Term Life Insurance, Copay, Credit, Credit based insurance score, Credit card, forgery and counterfeit money coverage, Creditable Coverage, Customization, Date of Issue, Date of Loss, Declarations, Declarations page, Declination, Deductible, Dental insurance, Dependent, Depreciation, Direct Loss, Directors & Officers Liability, Disability Income, Dividend, Domestic Insurer, Double Indemnity, Dwelling, Dwelling replacement cost, Earned Premium, Earthquake, Effective Date, Emergency Room Visit, Employers Liability, Endorsement, Enrollment, Exclusion, Exclusions and Limitations, Exposure, Extended Term Life Insurance, Face Amount, Fair Value, FEMA, Fidelity, Financial Reporting, Financial Responsibility Law, Financial Statement, Fire, Flood, Foreign Insurer, Garaging location, Gated community, Generally Accepted Accounting Principles, Grace Period, Gross Premium, Group Health Insurance, Guaranteed Renewable Policy, Guaranty Association, Guaranty Fund, Hagerty, Hazard, Health Insurance, Health Plan, HIPPA, HMO plan, Homeowners Insurance, Hurricane/named storm deductible, Identity theft coverage, Incontestability Provision, Incontestable Clause, Indemnification, Independent Adjuster, Independent Agent, Independent Contractor, Individual Health, Inland Marine, Insurable interest, Insurance, Insurance Company, Insurance to Value, Insured, Insurer, Irrevocable Beneficiary, Joint-Life Annuity, Key Employee, Kit Car, Lapse, Lapse Level Premium Insurance, Lease, Leaseholder, Lessee, Liability, Liability coverage, Liability insurance, Lien, Lien holder, Life insurance, Life Settlements, Lifetime Maximum, Limited Policies, Limits, Limits of insurance, Line of Business, Long-Term Care, Long-term disability insurance, Loss, Loss assessment coverage, Loss Frequency, Loss history, Loss of use, Loss Payable Clause, Loss Ratio Loss Reserves, Losses Incurred, Major medical insurance, Malicious mischief, Market value, Medical payment insurance, Medical Payments Coverage, Medical Professional Liability, Medicare, Member, Misrepresentation, Mitigation, Mobile Homes, Modified Guaranteed, Morale Hazard, Morbidity, Morbidity Risk, Morbidity Table, Mortality Table, Mortgage, Mortgage Guaranty, Mortgage Insurance, Motor vehicle report, Multi-Peril Insurance, Municipal Liability., Municipal obligation bond, Named insured, Named non-owner coverage/policy, Named Peril Coverage, Named perils, National Association of Insurance Commissioners, Negligence, Net Admitted Assets, Net Income, Net Premiums Earned, Network, No-fault insurance, Non-standard carrier, Occasional driver, Occupancy, Occurrence, Ocean Marine, Officer, Option, Ordinance or law coverage, Original equipment manufacturer, Other structure, Out-of-Network, Out-of-Pocket Expense, Owner Occupied, Package Policy, Paid-up Policy, Par Value, Peril, Permanent Insurance, Permanent Life Insurance, Personal Auto Policy, Personal Earthquake, Personal effects, Personal Flood, Personal GAP Insurance, Personal injury, Personal Injury Liability, Personal injury protection, Personal Property, Personal Umbrella Policy, Pet Insurance Plans, Physical damage, PMO plan, Policy, Policy Declarations, Policy Dividend, Policy Limits, Policy Loan, Policy owner, Policy Period, Policy Reserve, Policyholder, Policyholders Surplus, Pool, PPO, Preferred Provider Organization (PPO), Preferred Risk, Premises and Operations, Premium, Premiums Earned, Premiums Net, Premiums Written, Primary Beneficiary, Primary Care Physician, Primary driver, Primary Insurance, Primary use, Prior Approval Law, Private Mortgage Insurance (PMI), Private Passenger Auto (PPA), Probationary Period, Producer, Product Liability, Professional Errors and Omissions Liability, Professional liability insurance, Proof of Loss, Property, Property damage liability coverage, Property fire wall, Pro-rata Reinsurance, Protected Cell, Protection Amount, Protection and Indemnity, Protective devices, Provisions, Proximate Cause, Public Adjuster, Pure Premium, Pure Risk, Rate, Rated Policy, Real property, Rebate, Reimbursement, Reinstatement, Reinsurance and Renewable Term Life Insurance.

⚠ This card has duplicate items: Fire (2), Deductible (2), Liability (2), Personal Property (2), Peril (2), Brand New Belongings (2), Binder (2)

Valinda Burks Agency - Bingo | insurance Bingo | insurance Bingo | insurance Bingo | Insurance Bingo

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.