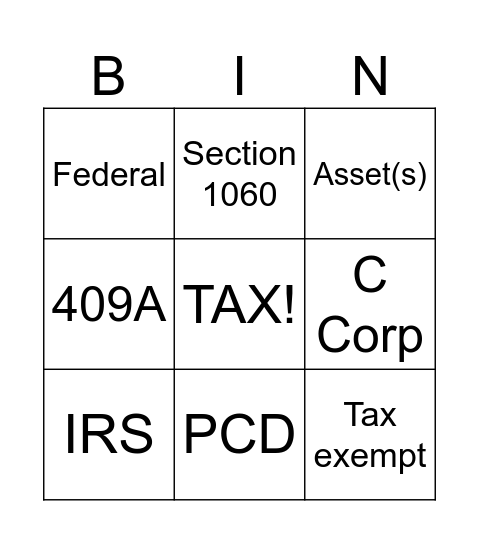

This bingo card has a free space and 49 words: Section 351, Section 721, Section 1031, Section 1014, Section 2701, Section 368, Section 1060, S Corp, C Corp, Election, IRS, 409A, Deduction, Credit, Capital Gains, Exemption(s), PCD, Capital Loss, Depreciation, Tax exempt, Sales tax, State tax, Federal, Adjusted Gross Income, Alternative Minimum Tax, Assessed Valuation, Unrelated Business Income, Appeal, Audit, Net Operating Loss, IRA, 401K, AMORTIZATION/Amortize, BASIS, CAPITAL ASSET, Dependent, Tax rate (or bracket), Estate, Income, Inherit or inheritance, Return, File, Property, Goodwill, Tangible, Asset(s), EBITDA, Unrelated Business Income and Form 990.

⚠ This card has duplicate items: Unrelated Business Income (2)

Tax Terms Bingo | FIN 2150 CH. 3-5 | 10 Commerce- Investing Revision | EY PAS United Way Bingo | Tax Lingo Bingo

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.