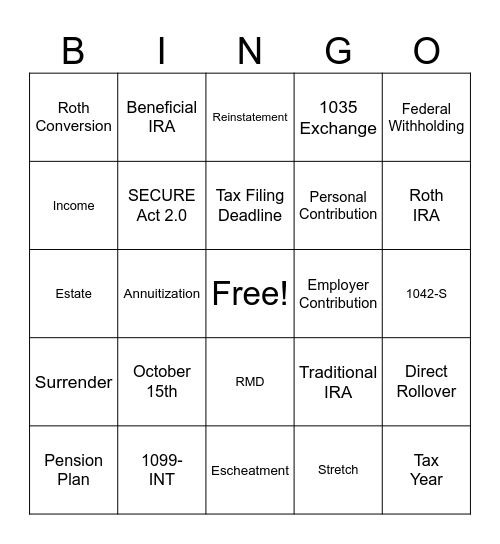

This bingo card has a free space and 69 words: 1099-R, 1042-S, 5498, 1099-MISC, 1099-INT, 1099-NEC, 1035 Exchange, State Withholding, Federal Withholding, Transfer, Direct Rollover, Indirect Rollover, Roth Conversion, Reinstatement, Cost Basis, Annuitization, RMD, Personal Contribution, Fair Market Value, Surrender, Employer Contribution, Traditional IRA, Roth IRA, SEP IRA, SIMPLE IRA, Non-Qualified, Self Certification, Lump Sum, Stretch, Tax Plan, Beneficial IRA, Inherited IRA, 401(k), 403(b), Distribution Codes, Non-Resident Alien, Resident Alien, IRS, Income, April 15th, October 15th, Tax Year, January 31st, December 31st, Custodial IRA, Pension Plan, 59 1/2, 73, W-4R, SECURE Act 2.0, Tax Filing Deadline, 5-Year Deferral, 10-Year Deferral, Escheatment, Correction, Tax Information, Tax Advice, Joint Owners, Beneficiary, Estate, Periodic Payments, Non-Periodic Payments, Portability Grids, W-8BEN, Special 5498 Reporting, W-4P, Mandatory, Voluntary and Prohibited.

Policyholder Tax Bingo | IRA Bingo | CLINT'S IRA | IRA Bingo | Ascensus Bingo

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.