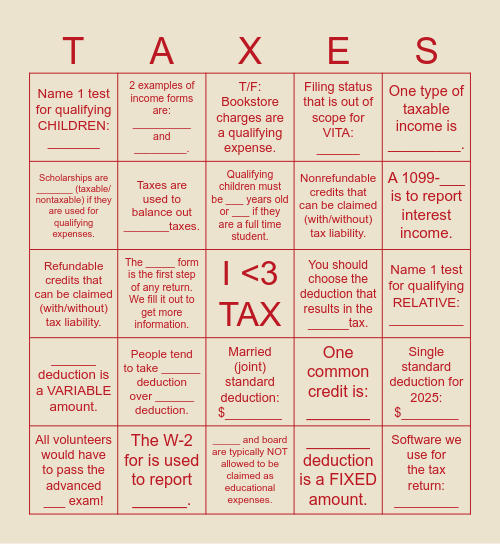

This bingo card has a free space and 26 words: Married (joint) standard deduction: $________, _______ deduction is a FIXED amount., Qualifying children must be ___ years old or ___ if they are a full time student., The W-2 for is used to report ______., One type of taxable income is _________., Name 1 test for qualifying CHILDREN: _______, Scholarships are _______ (taxable/ nontaxable) if they are used for qualifying expenses., 2 examples of income forms are: __________ and _________., Name 1 test for qualifying RELATIVE: __________, One common credit is: _______, Nonrefundable credits that can be claimed (with/without) tax liability., Refundable credits that can be claimed (with/without) tax liability., Single standard deduction for 2025: $________, All volunteers would have to pass the advanced ___ exam!, The _____ form is the first step of any return. We fill it out to get more information., T/F: Gain on stocks is taxable., Filing status that is out of scope for VITA: ______, ______ deduction is a VARIABLE amount., T/F: Bookstore charges are a qualifying expense., Software we use for the tax return: _________, A 1099-___ is to report interest income., _____ and board are typically NOT allowed to be claimed as educational expenses., You should choose the deduction that results in the ______tax., People tend to take ______ deduction over ______ deduction., Taxes are used to balance out _______taxes. and One type of nontaxable income is ____________..

GM #1 | GM #1 | GM #1 | GM 1 Guided Notes | GM #1

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.