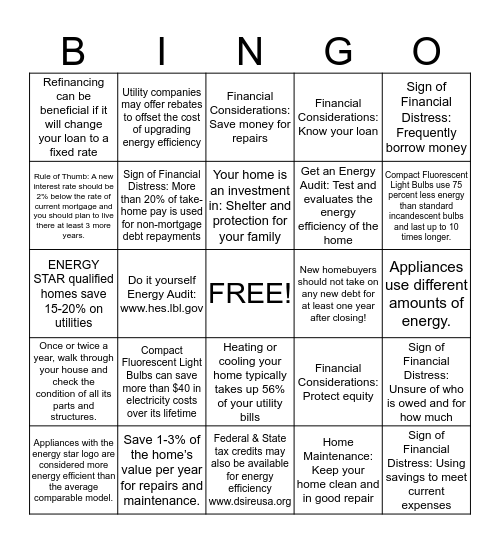

This bingo card has a free space and 42 words: Protecting your home is more than just adding locks or smoke detectors, Your home is an investment in: Shelter and protection for your family, Your home is an investment in: Your financial future, Compact Fluorescent Light Bulbs can save more than $40 in electricity costs over its lifetime, Home Maintenance: Keep your home clean and in good repair, Sign of Financial Distress: Unsure of who is owed and for how much, Sign of Financial Distress: Using savings to meet current expenses, Financial Considerations: Save money for repairs, Financial Considerations: Save money for repairs, Heating or cooling your home typically takes up 56% of your utility bills, Appliances use different amounts of energy., Compact Fluorescent Light Bulbs use 75 percent less energy than standard incandescent bulbs and last up to 10 times longer., Do it yourself Energy Audit: www.hes.lbl.gov, Sign of Financial Distress: Frequently borrow money, Your home is an investment in: The life and health of your community, Financial Considerations: Protect equity, Safety repairs should come before aesthetic repairs or improvements, ENERGY STAR qualified homes save 15-20% on utilities, Sign of Financial Distress: Rely on Overtime, Utility companies may offer rebates to offset the cost of upgrading energy efficiency, Rule of Thumb: A new interest rate should be 2% below the rate of current mortgage and you should plan to live there at least 3 more years., Refinancing can be beneficial if it will decrease your payment amount, Refinancing can be beneficial if it will decrease the total interest paid, Refinancing can be beneficial if it will change your loan to a fixed rate, Financial Considerations: Beware of rescue scams and predatory lenders., Financial Considerations: Prioritize expenses, Get an Energy Audit: Test and evaluates the energy efficiency of the home, It may take up to a year to adjust to mortgage payments and the true costs of home ownership., An energy efficient appliance may cost more upfront but operating cost is less., Closing costs will be charged for a refinance!, Sign of Financial Distress: Only able to make minimum payments, Once or twice a year, walk through your house and check the condition of all its parts and structures., Sign of Financial Distress: More than 20% of take-home pay is used for non-mortgage debt repayments, Federal & State tax credits may also be available for energy efficiency www.dsireusa.org, Financial Considerations: Contact a HUD approved Housing Counseling Agency, Appliances with the energy star logo are considered more energy efficient than the average comparable model., Save 1-3% of the home’s value per year for repairs and maintenance., New homebuyers should not take on any new debt for at least one year after closing!, There are other options besides foreclosure., A foreclosure prevention counselor will help evaluate your options., Financial Considerations: Know your loan and Financial Considerations: Adjust your budget.

⚠ This card has duplicate items: Financial Considerations: Save money for repairs (2)

Rent or Own? | MakingCents | Keys & Closings Bingo | Home Loan Referrals | Home Loan5

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.