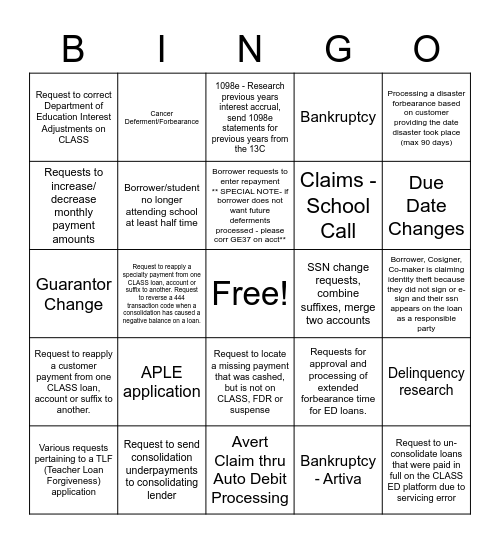

This bingo card has a free space and 89 words: 3rd Party Bank Holder Demos, Benefit Reinstatement, Avert Claim thru Auto Debit Processing, Avert - Payment Made, Closed School, Auto Debit, Request for Credit Bureau Retraction, Avert Claim thru Deferment Processing, Bank Call, Defense to Repayment, CDA Removal, Ability to Benefit, Bankruptcy, Delinquency research, FDR - 3rd Party Bank Holder Demos, APLE application, Avert Claim thru Forbearance Processing, Bankruptcy - Artiva, Disability, For borrower/cosigner requests to removed a dispute narrative, Death Notification, Avert Claim Separation Date Change, Claims -School Call, Guarantor Call, Guarantor Change, Write up or Write off, Request to change a Deferment Interest Code or Borrower Type, Loan Repayment Forgiveness Form Completion, Excessive Title IV Forbearance (FRAT) or Forbearance (FORB/FORV), Repurchase processing and verification of the Repurchase Calculation, Borrower/student no longer attending school at least half time, Borrower requests to enter repayment ** SPECIAL NOTE- if borrower does not want future deferments processed - please corr GE37 on acct**, Requests for documents located on microfilm. Must provide micro address and source code from 151 screen., Processing a disaster forbearance based on customer providing the date disaster took place (max 90 days), Account Restructures – invalid balances on account, Cancer Deferment/Forbearance, 1098e - Research previous years interest accrual, send 1098e statements for previous years from the 13C, Request for documents to be pulled, requested from previous lender/servicer/COD/DLCS, or from original file and imaged to ECS. Includes requests to obtain promissory notes for ED-owned loans., Borrower, Cosigner, Co-maker is claiming identity theft because they did not sign or e-sign and their ssn appears on the loan as a responsible party, Subsidized/Unsubsidized indicator adjustment, Processing a deferment based on missing information. Request to shorten or remove a deferment. Adding a loan going into repayment to the existing deferment (example: other loans in DHAR, DINT or DUEM status)., Requests for documents from ECS - Including letter copies, promissory notes, and prior lender histories. *Must be on ECS*, request a copy of the W-9 for Commercial and ED., Aidvantage or a customer discovers suspicious activity on a Aidvantage account. Activity such as multiple payments made from a closed or unauthorized bank account, also any changes made to an account without a customer's authority, Various requests pertaining to a TLF (Teacher Loan Forgiveness) application, In School Deferment Request - Borrower Enrolled, Request a document from Indiana Document Capture. Only use for documents that were processed in Indiana, Florida, Texas or Seattle centers., Requests for approval and processing of extended forbearance time for ED loans., Request to have GRCE period restored or researched, Request to correct Department of Education Interest Adjustments on CLASS, Request for interest rate, change, calculation of Interest Accrual, Max Interest Adjustments, Requests to have the cosigner removed from the loan and have the borrower become the sole responsible party for the loan., Alignment of status Begin & End Dates, Repayment Begin Dates, Disbursement Date Changes, Disbursement Amount, and Loan Period, Requests for a Program Change, Request to merge loans (reallocation of principal and interest balance), Research accounts with negative balances and initiate refund if applicable, SSN change requests, combine suffixes, merge two accounts, Correcting Repayment Terms on Loan(s), Summary of the interaction including any action taken from an escalated contact from an IL customer., Requests to send manual letters regarding repayment options., A request should be sent when a standard pay history is not sufficient, and the customer is unable/unwilling to review their declining-balance history online or needs a copy by mail or fax., Request for a manual letter to provide information that is not available in a system letter. Letters for accounts on Y system, Requests to reapply a borrower payment (Tran Code 101) as a customer refund (Tran Code 135) on FFELP/DL Loans ONLY. Requests to reapply a customer refund (Tran Code 135) as a borrower payment (Tran Code 101) on FFELP/DL Loans ONLY., Request to correct customer bill payer scan line, Request to reverse or repost capitalized interest., Request to have a check copy pulled., Request to reapply a claims payment from one CLASS loan, account or suffix to another., Request to un-consolidate loans that were paid in full on the CLASS ED platform due to servicing error, Request to reapply a customer payment from one CLASS loan, account or suffix to another., Request to send consolidation underpayments to consolidating lender, Request to locate a missing payment that was cashed, but is not on CLASS, FDR or suspense, Request to have check copies pulled for multiple payments, subpoenas and legal requests., Due Date Changes, Requests to increase/ decrease monthly payment amounts, Request to review payment history for payment allocation and balance disputes, Request to adjust or advance the payment counters for a payment received., Review payment counters for discrepancies ****DOES NOT INCLUDE LOAN FORGIVENESS COUNTERS****, Request to correct a payment encoding error, Request to research underpaid consolidation payment amount. Request to reapply funds on underlying loans with a negative balance to a consolidation loan. Request to reapply a payment received prior to consolidation being completed once the con, Request to reapply a specialty payment from one CLASS loan, account or suffix to another. Request to reverse a 444 transaction code when a consolidation has caused a negative balance on a loan., Request to void a customer payment that has not been processed yet (Payment can be voided up until 8:00 PM of the date that the payment will be charged to the credit card)., Request to post a payment from suspense to a customer's account, or to refund a payment from suspense to the remitter., Request for Commercial and ED loan that need to have a POA added (need the POA form document # in ECS), when a POA timeframe needs to be added or adjusted (need the POA form document # in ECS), and when a POA needs to be removed, This queue is only for loans that have been serviced by Aidvantage since disbursement, This queue is only for loans that had previously been serviced with another company, where the disbursement date is older than the servicing date greater than 1 month, For requests to expedite processing on an already received Income Driven Repayment plan application (for IDR, REPAYE, PAYE, IBR and ICR only)., For requests to have an account researched related to a customer's Income Driven Repayment plan request or processing (for IDR, REPAYE, PAYE, IBR and ICR only). and For requests related to Income Sensitive Repayment (ISR), Graduated, Extended, or any other non-IDR repayment plan..

IDT's | IDT's | IDT's | 💰💲💰💲💰💲💰 | New Hire Training - Fundamental

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.