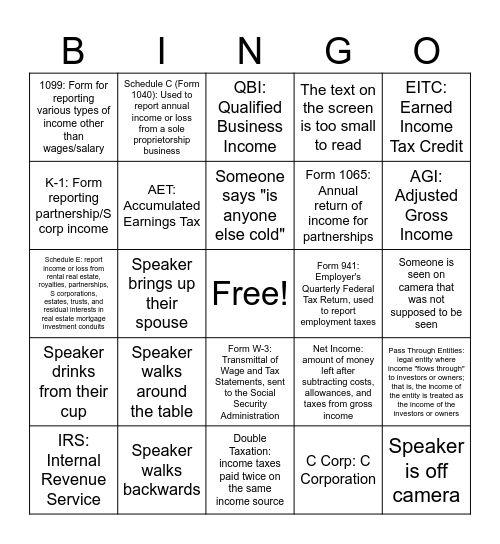

This bingo card has a free space and 24 words: Speaker walks around the table, Speaker walks backwards, Someone says "is anyone else cold", IRS: Internal Revenue Service, EITC: Earned Income Tax Credit, 1099: Form for reporting various types of income other than wages/salary, K-1: Form reporting partnership/S corp income, Schedule C (Form 1040): Used to report annual income or loss from a sole proprietorship business, Form 941: Employer's Quarterly Federal Tax Return, used to report employment taxes, Form W-3: Transmittal of Wage and Tax Statements, sent to the Social Security Administration, Form 1065: Annual return of income for partnerships, Schedule E: report income or loss from rental real estate, royalties, partnerships, S corporations, estates, trusts, and residual interests in real estate mortgage investment conduits, Net Income: amount of money left after subtracting costs, allowances, and taxes from gross income, Pass Through Entities: legal entity where income "flows through" to investors or owners; that is, the income of the entity is treated as the income of the investors or owners, AET: Accumulated Earnings Tax, C Corp: C Corporation, Someone is seen on camera that was not supposed to be seen, QBI: Qualified Business Income, AGI: Adjusted Gross Income, Speaker brings up their spouse, Speaker is off camera, Speaker drinks from their cup, The text on the screen is too small to read and Double Taxation: income taxes paid twice on the same income source.

Self Employment BINGO | TAX BINGO | Tax Terms Bingo | JACKSON HEWITT | Business Tax In Depth Webinar BINGO

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.