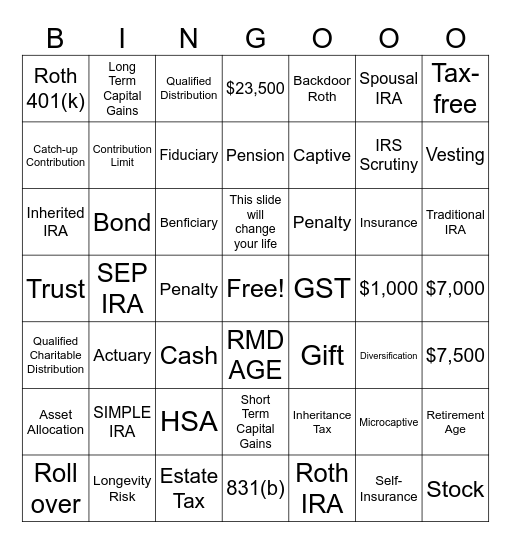

This bingo card has a free space and 55 words: Roth IRA, Traditional IRA, 401(k), Roth 401(k), SEP IRA, SIMPLE IRA, Tax-free, Required Minimum Distribution, Contribution Limit, HSA, $23,500, $7,500, $7,000, $1,000, Roll over, Qualified Charitable Distribution, Backdoor Roth, Captive, Self-Insurance, IRS Scrutiny, Vesting, Actuary, Penalty, Qualified Distribution, Roth Conversion, Catch-up Contribution, Penalty, Income Limits, Inherited IRA, Insurance, Annuity, Diversification, Retirement Age, Longevity Risk, Spousal IRA, Pension, Asset Allocation, Bond, Stock, Cash, Long Term Capital Gains, Short Term Capital Gains, Inheritance Tax, Step Up, Benficiary, Trust, Estate Tax, Gift, GST, Fiduciary, RMD AGE, Microcaptive, 831(b), This slide will change your life and Death, taxes, and this presentation.

⚠ This card has duplicate items: Penalty (2)

NAF Lesson 18-20 | Policyholder Tax Bingo | Policyholder Tax Bingo | CLINT'S IRA | Retirement Plan FAQs

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.