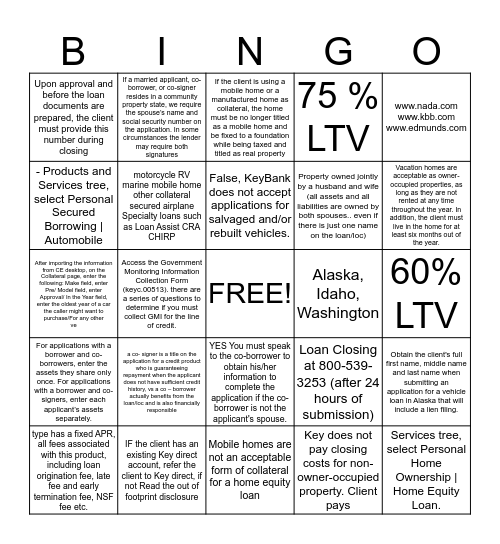

This bingo card has a free space and 24 words: a co- signer is a title on the application for a credit product who is guaranteeing repayment when the applicant does not have sufficient credit history, vs a co – borrower actually benefits from the loan/loc and is also financially responsible, IF the client has an existing Key direct account, refer the client to Key direct, if not Read the out of footprint disclosure, False, KeyBank does not accept applications for salvaged and/or rebuilt vehicles., type has a fixed APR, all fees associated with this product, including loan origination fee, late fee and early termination fee, NSF fee etc., www.nada.com www.kbb.com www.edmunds.com, Upon approval and before the loan documents are prepared, the client must provide this number during closing, - Products and Services tree, select Personal Secured Borrowing | Automobile, If a married applicant, co-borrower, or co-signer resides in a community property state, we require the spouse’s name and social security number on the application. In some circumstances the lender may require both signatures, Alaska, Idaho, Washington, YES You must speak to the co-borrower to obtain his/her information to complete the application if the co-borrower is not the applicant's spouse., Property owned jointly by a husband and wife (all assets and all liabilities are owned by both spouses.. even if there is just one name on the loan/loc), After importing the information from CE desktop, on the Collateral page, enter the following: Make field, enter Pre/ Model field, enter Approval/ In the Year field, enter the oldest year of a car the caller might want to purchase/For any other ve, Loan Closing at 800-539-3253 (after 24 hours of submission), Obtain the client's full first name, middle name and last name when submitting an application for a vehicle loan in Alaska that will include a lien filing., motorcycle RV marine mobile home other collateral secured airplane Specialty loans such as Loan Assist CRA CHIRP, Key does not pay closing costs for non-owner-occupied property. Client pays, 60% LTV, If the client is using a mobile home or a manufactured home as collateral, the home must be no longer titled as a mobile home and be fixed to a foundation while being taxed and titled as real property, Vacation homes are acceptable as owner-occupied properties, as long as they are not rented at any time throughout the year. In addition, the client must live in the home for at least six months out of the year., Access the Government Monitoring Information Collection Form (keyc.00513). there are a series of questions to determine if you must collect GMI for the line of credit., Services tree, select Personal Home Ownership | Home Equity Loan., For applications with a borrower and co-borrowers, enter the assets they share only once. For applications with a borrower and co-signers, enter each applicant’s assets separately., 75 % LTV and Mobile homes are not an acceptable form of collateral for a home equity loan.

Mortgage Bingo | Mortgage Bingo | Homebuyer's Bingo | Purchase Title Coordinator | Credit Sales Procedures

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.