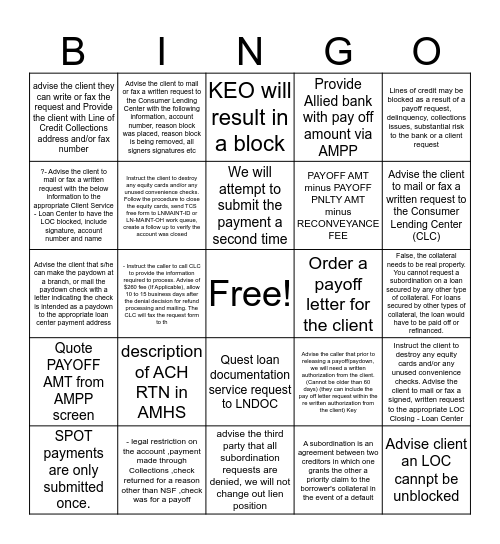

This bingo card has a free space and 24 words: description of ACH RTN in AMHS, - legal restriction on the account ,payment made through Collections ,check returned for a reason other than NSF ,check was for a payoff, We will attempt to submit the payment a second time, SPOT payments are only submitted once., Lines of credit may be blocked as a result of a payoff request, delinquency, collections issues, substantial risk to the bank or a client request, advise the client they can write or fax the request and Provide the client with Line of Credit Collections address and/or fax number, ?- Advise the client to mail or fax a written request with the below information to the appropriate Client Service - Loan Center to have the LOC blocked, include signature, account number and name, Advise the client to mail or fax a written request to the Consumer Lending Center with the following information, account number, reason block was placed, reason block is being removed, all signers signatures etc, Order a payoff letter for the client, Quest loan documentation service request to LNDOC, PAYOFF AMT minus PAYOFF PNLTY AMT minus RECONVEYANCE FEE, Advise the client that s/he can make the paydown at a branch, or mail the paydown check with a letter indicating the check is intended as a paydown to the appropriate loan center payment address, Advise the caller that prior to releasing a payoff/paydown, we will need a written authorization from the client. (Cannot be older than 60 days) (they can include the pay off letter request within the re written authorization from the client) Key, Instruct the client to destroy any equity cards and/or any unused convenience checks. Advise the client to mail or fax a signed, written request to the appropriate LOC Closing - Loan Center, Instruct the client to destroy any equity cards and/or any unused convenience checks. Follow the procedure to close the equity cards, send TCS free form to LNMAINT-ID or LN-MAINT-OH work queue, create a follow up to verify the account was closed, A subordination is an agreement between two creditors in which one grants the other a priority claim to the borrower's collateral in the event of a default, False, the collateral needs to be real property. You cannot request a subordination on a loan secured by any other type of collateral. For loans secured by other types of collateral, the loan would have to be paid off or refinanced., KEO will result in a block, Advise the client to mail or fax a written request to the Consumer Lending Center (CLC), - Instruct the caller to call CLC to provide the information required to process. Advise of $260 fee (If Applicable), allow 10 to 15 business days after the denial decision for refund processing and mailing. The CLC will fax the request form to th, Advise client an LOC cannpt be unblocked, Quote PAYOFF AMT from AMPP screen, Provide Allied bank with pay off amount via AMPP and advise the third party that all subordination requests are denied, we will not change out lien position.

LOC procedures | LOC procedures | Installment Loan | Installment Loan Review | LOC BINGO

Share this URL with your players:

For more control of your online game, create a clone of this card first.

Learn how to conduct a bingo game.

With players vying for a you'll have to call about __ items before someone wins. There's a __% chance that a lucky player would win after calling __ items.

Tip: If you want your game to last longer (on average), add more unique words/images to it.